Article

The Inflation Reduction Act at a glance

US Inflation Reduction Act, 12 July 2023

The IRA – how this three-letter act is significantly advancing decarbonization and disrupting global hydrogen market competitiveness

The Inflation Reduction act marks the most significant legislation in slowing climate change in US history. With hundreds of billions of dollars committed to the clean energy economy through tax credits, grants, and loan guarantees, the US market for renewable energy is set to explode. In this article, we discuss the significance of this bill and how this funding dramatically alters the domestic and global landscapes for the renewable energy and hydrogen.

When President Joe Biden signed the Inflation Reduction Act (IRA) into law on 16 August 2022, he enacted the largest investment in climate and energy in the US to date and thereby changed the market for renewable energy for a decade with a single stroke of a pen. Well… to say a single stroke of a pen is quite an oversimplification as the IRA took countless hours of negotiation and a total revamp of the once named Build Back Better Plan that Biden campaigned on, all to get to a 274-page bill that will have massive implication for the nation and the world.

And today, almost a year since the IRA was signed, the momentum around this bill is still very high. Investment in the renewable energy world is booming and we are seeing new players trying to enter the US market, while many existing US energy companies are diversifying into new technologies, particularly low carbon hydrogen and storage.

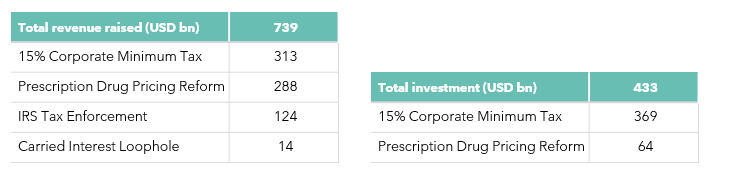

In total, the bill will lead to spending amounting to just about half a trillion dollars over the next decade (for a breakdown, please see note 1). It is no small chunk of change, but at approximately USD 43 bn per year, this would represent about just 0.7% of US Government spending when compared to the 2022 fiscal year. Most of that money will be spent on Energy Security and Climate Change programs, with approximately USD 369 bn dedicated to these programs over the next ten years. The remainder is dedicated to extending the expanded Affordable Care Act program for three years. In terms of where that money is coming from, the funds will be raised through several ways, most notably by enacting a 15% Corporate Minimum Tax. Revenue sources are estimated to generate USD 739 bn, meaning the bill expects to eat into the US budget deficit (see appendix for additional details).

We plan to spend the rest of this article discussing the significance of this bill and by extension, the funding, for the renewable energy and hydrogen markets. The biggest pool of money set aside in the bill is for the expansion and extension of the Production Tax Credit (PTC) and Investment Tax Credit (ITC) for wind and solar, a newly implemented ITC available for standalone battery storage, and new credit support for hydrogen, nuclear, and carbon capture through 2032 (for additional information on how these credits work, please see note 2). The wind and solar credits are significant support initiatives but are not overly groundbreaking and rather represent a continuation of a program that already existed. And while the money is crucially important, the new structure of how these credits can be monetized is perhaps more important. The bill now introduces transferability, a welcomed addition for those who are familiar with the complex US tax equity structure.

Tax equity financing is a complicated financing structure, with high transaction costs, which requires banks or other sophisticated investors with high tax liabilities to make an equity investment in a project so they can be assigned the rights to claim the tax benefits generated from ITC/PTC and depreciation. This is beneficial to the project since projects are usually inefficient taxpayers and must carry credits forward, reducing their benefit. By using tax equity, the project is able to monetize the credits upfront, but must implement this structure with complicated legal, tax, and accounting implications. Transferability, on the other hand, will now allow the project to sell credits directly on an open market to any business, without them needing to take an equity investment in the project. This will open the door for a wider range of corporates to participate in the market for credits, as any organization with tax liability will be able to directly purchase these credits to offset their tax liability. And while the market is still looking to Treasury for guidance about various issues, this new method for monetizing tax credits should yield the positive impacts of process simplification, lower transaction costs, and a deeper market for selling credits.

In addition to transferability, the IRA offers direct pay for select technologies, such as green hydrogen and carbon sequestration, as well as tax-exempt entities like state and local governments and Tribal/Native governments. Direct pay is a payment received from the Internal Revenue Service (IRS) through a cash refund for any amount in excess of a project’s yearly tax liability. This guarantees that developers can fully monetize the value of their tax credits. Put simply, come tax time, the IRS will write a check for the value of the tax credits for those who qualify for direct pay.

With these impacts, the IRA provides another catalyst to an already rapidly growing renewable sector and will accelerate trajectory toward the US goals of a decarbonized power sector by 2035 and net zero emissions overall by 2050. Through 2030, the IRA is estimated to lead to new, utility-scale clean power capacity installations growing at a 13% CAGR and resulting in between 525 to 550 GW coming online, according to American Clean Power. In comparison, without the passing of the IRA, industry forecasts projected utility-scale clean power capacity additions of 335 GW. The improved economics of projects resulting from the IRA will make additional projects viable that otherwise may not have been without these effects. A major boost for solar and wind projects, the additional financial benefits from IRA tax credits will open new areas of the country to projects, especially those with land costs higher and capacity factors lower than typical projects that may not have otherwise been feasible. But these benefits do not come without at least some challenges. The increasing number of renewable energy projects buoyed by the favorable federal policy will also worsen (the already very high) congestion and curtailment costs that energy companies are facing in all the American ISOs (Independent System Operators). Consequently, substantial new transmission capacity will have to be developed quickly to accommodate the increasing wind and solar pipeline. In addition, the recent rising interest rates and instability in the banking sector are causing new issues for the financing of the projects. And ultimately, developers are facing complexities resulting from the IRS not yet having provided guidance on some aspects of the law.

What really saw the greatest impact in the IRA was the support scheme for a budding standalone storage industry and green hydrogen market. Before the enactment of the IRA, the ITC did not apply to standalone storage projects. This means that when an energy storage project was grid connected and charged more than 20% power from the grid, the project could not claim an ITC. The additions made in the IRA now enable standalone energy storage projects of > 5kWh to receive a 30% ITC when prevailing wage and apprenticeship requirements are met – a requirement for >1MW projects or the ITC drops to 6% otherwise (see note 3). The ITC will be available in full until 2033. This new provision now allows energy storage projects to decouple battery storage from generation (i.e. a project can claim PTC for a wind resource, and ITC for the storage part independently). Nonetheless there is still some clarity needed and we expect more regulatory guidance soon regarding who is entitled to receive which tax credits in an integrated storage system. These key measures are boosting the standalone energy storage industry, which is critically important as we seek to balance the intermittent generation of renewables. With that said, we at Green Giraffe have witnessed an increased interest and new entrants in the storage market over the past few months.

To boost the clean hydrogen market, the IRA offers a new ten-year incentive for clean hydrogen projects that begin construction prior to 2033 with up to 3 USD/kg production tax credit (PTC) or a 30% investment tax credit (ITC) assuming prevailing wages and apprenticeship requirements are met. The credit amounts are highly dependent on the carbon intensity of the energy sources and technologies used and credits will be granted when lifecycle GHG emissions are lower than 4 kg CO2/kgH2. Now thanks to these credits, US green hydrogen is globally much more cost competitive than that of the EU. A recent study from Deloitte estimates that the cost of shipping green hydrogen, in the form of ammonia, from the US to Europe and then cracking that ammonia back into hydrogen would be about 1.5-2.5 USD/kgH2 (taking into account the 3 USD/kg H2 tax credit), compared to EU’s estimate at 3-4 USD/kg H2 in 2030.

And the market price imbalances do not stop there. On top of incentivizing green project developers to purchase US-made equipment (see note 3), the IRA offers new Advanced Manufacturing Production Credits (AMPC) until 2032 for domestic manufacturing of components such as blades, inverters, battery cells, photovoltaic wafers, solar modules and critical minerals processing. Overall, the IRA creates a disparity between US and international suppliers which will grow the US local supply chain and surely spur the development of new equipment supply chains.

However, there is a major mismatch between the high number of potential suppliers and the low number of offtakers, hence US projects are struggling to secure long term contracts, which delays projects’ final investment decisions. The DOE filed a notice of intent early June 2023, which includes a consultation running up to 24 July 2023, to provide USD 1bn of demand-side subsidies – the subsidy mechanism is being discussed. This support will be linked to the H2Hubs initiative, which aims to spend up to USD 7bn on six to ten regional hubs.

The IRA represents a monumental change and lift to the US renewables market (significant tax subsidies and incentives to buy US-made products), but the impact goes beyond. The effect is not only limited to what the bill actually does, but also what it forces the rest of the world to do, to keep up, which will ultimately have a greater impact for international markets and the entire planet’s decarbonization.

The EU and the rest of the world cannot and will not sit back and accept this new market imbalance, and as such the passing of the IRA has significant implications, especially in providing momentum towards an adoption of EU support schemes. In fact, EU regulators perceive the IRA as a violation of the World Trade Organization rules, with other countries such as Norway, Australia, Japan and South Korea raising similar concerns. Amongst others, there is a fear that European developers will be incentivized to move to the US, and that EU equipment exports to the US will be hampered. But since chances of amending the IRA are very low, countries will have to align on the support levels of the IRA to remain competitive.

The EU Commission President Ursula von der Leyen spoke at the last World Economic Forum in Davos early March and described the “Net-Zero Industry Act” strategy to respond to Biden’s IRA, stating “to keep European industry attractive, there is a need to be competitive with offers and incentives that are currently available outside the European Union.”

The “Net-Zero Industry Act” aims at simplifying access to subsidies, adapting state aid rules, building an EU workforce to support the green transformation, and swiftly responding to unfair international trade practices. To maintain and promote a European-based supply chain and develop new storage and hydrogen projects in Europe, the EU urgently needs US-style incentives, and easier permitting.

- In mid-February 2023, the European Commission published a long-waited definition for renewable liquid and gaseous transport fuels of non-biological origin (RFNBOs), which was accepted by the European Parliament and the 27 member states. These long-waited Delegated Acts give more visibility to the developers (even though some areas still need to be clarified)

- A contract for difference (CfD) scheme that aims to close the gap between green and grey hydrogen is also expected to be launched in 2023 under the USD 3 bn European Hydrogen Bank. The uncertainty around the ceiling price that will be used, and whether this will be different country by country and how it will be calculated in the future are still unknowns that urgently need to be clarified.

Outside of the EU, we also see other countries trying to progress on the support front. Last year the Canadian government vowed to respond to the US legislation with their own policy and recently unveiled a CAD 80 bn program for investment in the energy transition and low carbon economy. Australia is similarly taking steps. The Australian government also announced last May that they will invest USD 1.4 bn to scale up green hydrogen development. The funds will be allocated under a “Hydrogen Headstart” program that provides revenue support for large-scale green hydrogen projects through competitive hydrogen production contracts.

To conclude, the IRA is truly a global scale game changer. Governments around the world must react fast to implement proportionate policy and funding responses to the IRA, especially newly developing markets like clean hydrogen, for the risk of falling far behind is just too large. We will be watching closely to see how this legislation develops and are excited to help our clients who are entering, as well as those who are already established, to successfully participate in this booming US market. The path to decarbonization is still long but we are proud to see that the world is taking important steps forward.

Appendix

- IRA budget

The new proposal for the FY2022 Budget Reconciliation bill will invest approximately USD 300 bn in Deficit Reduction and USD 369 bn in Energy Security and Climate Change programs over the next ten years.

- PTC vs ITC

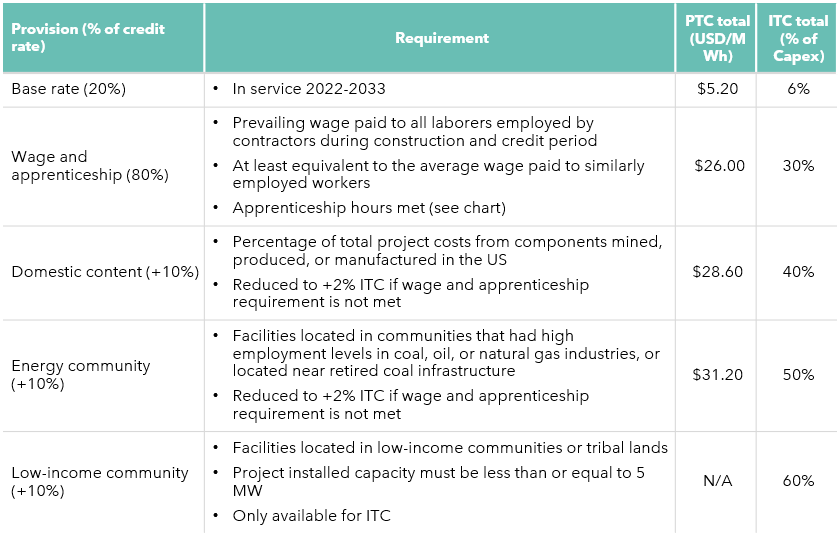

The Production Tax Credit (PTC) and Investment Tax Credit (ITC) credits function as dollar-for-dollar reductions in the income taxes required to be paid to the federal government rather than reductions to taxable income. The PTC is a variable payment awarded per MWh of electricity generation for a project’s first 10 operating years, while the ITC is one-time payment equal to percentage of total capex. The amounts of the credits earned varies depending on whether the project is able to meet a series of standards, shown in the table below. If you meet all ITC provisions, a project can receive up to 60% of the project CAPEX cost back in tax credits. Or USD 31.20 per MWh of generation if electing PTC. All in all, these credits represent quite a significant portion of the project cost.

- Credit rates and boosters