Blog post

Offshore wind: Glimmers of hope (and not from where you’d expect)

Offshore wind, 17 November 2023

On the surface of things, 2023 has not been the best year for offshore wind. For a sector used to good news, this year has brought a flood of the opposite:

- Vattenfall walked away from its 1.4 GW Norfolk Boreas project stating that market conditions had rendered it uneconomical (we wrote a blog post about this)

- The UK, long the leading market for offshore wind globally, launched an auction that attracted zero bids from offshore wind developers

- Poor financial results have required Siemens Gamesa, a leading turbine supplier, to apply for government support – it will be receiving EUR 7.5 billion in government guarantees

- And most recently, Ørsted took a USD 4 billion impairment charge and ceased development on two of its projects off the coast of New Jersey – Ocean Winds 1 and 2. Its share price dropped 26% following the news.

This doesn’t exactly paint a picture of a thriving sector; but this picture is also incomplete.

If we take a closer look, a more nuanced and positive story emerges – one that, if managed properly, will help lay the foundations for a more sustainable and resilient industry that can deliver on its ambitions. For that, we need to turn to the supply chain.

The supply chain has begun to return to profit

Despite a difficult year, Vestas returned to profit in Q3 2023, posting EUR 28 M in net profit, compared to a EUR 147 M loss over the same period in 2022. The Danish wind turbine supplier, thus, seems to have left its dismal financial performance over the past year behind it and has put itself on sturdier financial footing. Contributing to this turnaround was the fact that Vestas secured a bulk order of its V236-15.0 MW turbines for Orlen and Northland Power’s 1.2 GW Baltic Power offshore wind project in Poland (Green Giraffe Advisory was involved in this transaction). More recently, it won an order for the 504 MW Ulsan Gray Whale 4 floating offshore wind project in Korea. The path forward looks brighter.

This story is not just limited to the turbine suppliers. Prysmian Group, the Italian cabling giant, posted a net profit of EUR 575 M over the first 9 months of 2023, a 33% year-on-year increase. A key driver of this was the operational performance of its Power Distribution and OEM & Renewables business segments. Among other things, Prysmian provides cabling services to offshore wind projects and recently connected Vineyard Wind 1, the first utility-scale offshore wind farm in the US.

What we at Green Giraffe Advisory believe we are witnessing is a long overdue market correction. One, which shifts some value away from downstream production – where it has been concentrated – and distributes it across the mid- and upstream supply chain. The market has become a suppliers’ market.

The supply chain has had to accept drastic price reductions for too long

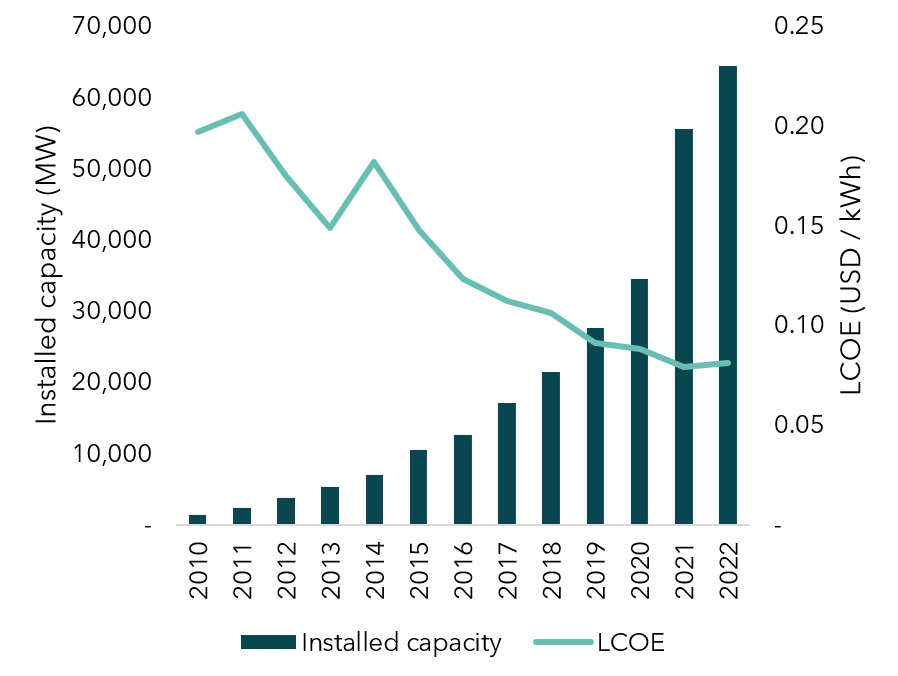

In 2022, an additional 8.8 GW of offshore wind was brought online, pushing total installed capacity to over 64 GW. The sector has grown a staggering 4,600% since 2010 (from 1.4 GW). As installed capacity increased, the levelized cost of electricity (LCOE) – a general indicator of the cost of electricity generated by a certain technology – dropped dramatically. Between 2010 and 2021, the global LCOE for offshore wind plummeted 60%, according to data from IRENA. Though it increased 2.5% year-on-year in 2022, the LCOE of offshore wind remained 59% cheaper than 2010.

Graph 1: installed capacity and LCOE of offshore wind, 2010-2022 (source: GWEC and IRENA)

The offshore wind sector has thus grown rapidly and become a lot cheaper. Although this is a good thing, a large part of these cost reductions has been borne by the supply chain – the turbine suppliers, the monopile producers, the installation vessels – upon which the industry depends. To illustrate this, we estimate the average cost of a turbine has almost halved from EUR 2 M/MW (2010) to EUR 1.2 M/MW (2021). Yet, despite the sector growing, the supply chain has been plagued by unsustainably low margins.

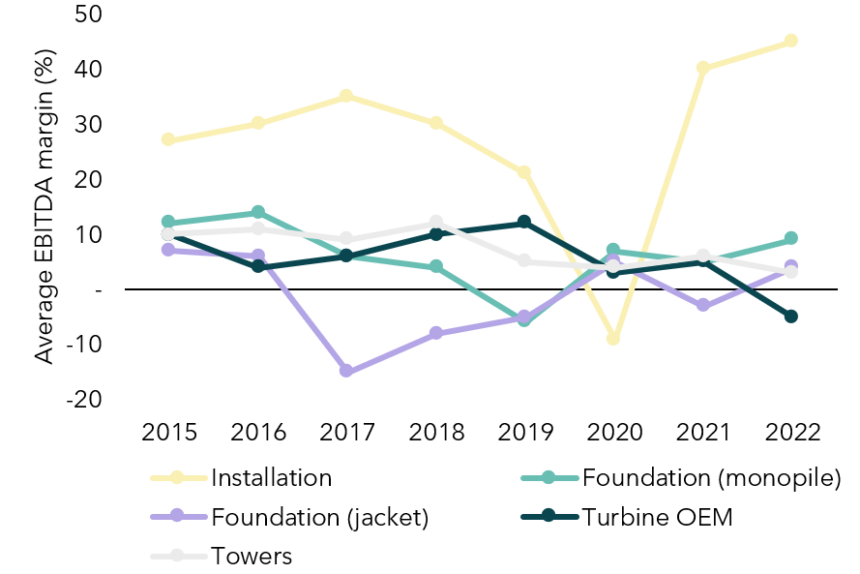

Graph 2: margins of supply chain operators (source: Wood Mackenzie)

Take Vestas and Siemens Gamesa, both tier 1 turbine suppliers – they are dealing with the paradoxical situation of being fully booked and yet not making any meaningful returns. In 2022, both posted EBITs of EUR – 1,596 M and EUR – 942 M, while having a combined order backlog of 15 GW, which will take 4-6 years to work through.

The story is similar for the monopile manufacturers, such a Bladt Industries and Steelwind, though the likes of SIF and EEW have reported more solid operating income recently. Nevertheless, the operating earnings these companies have accumulated over the past years are still insufficient to broaden their manufacturing base, despite a deficit in the monopile market. This is because the investment required to build new facilities is completely disproportional to the balance sheets of these manufacturers. SIF’s new monopile facility requires an investment of EUR 328 M, but the company’s balance sheet closed in 2022 at EUR 350 M.

Add to this the highest levels of inflation in decades, a subsequent surge in commodity prices (metal inputs approximately account for over 30% of turbine costs) and it’s no surprise that the supply chain was under so much stress, as not all of these costs could be passed on to customers – enough however, to make them struggle with their projects’ economics.

Graph 3: Eurozone inflation (source: Eurostat)

The result of all this: significantly higher industry costs. At Green Giraffe Advisory, we’ve seen the capex of offshore wind projects increase between 25-40% over the course of 2023.

Obviously, this impacts developers if they cannot pass such cost increases on to offtakers, but given the pressures that the supply chain has been facing, it is understandable. The supply chain squeeze, with unchanged levels of demand, has altered the balance of power in the market – from a buyer’s market, where developers held most of the power; to a seller’s market, where the supply chain finds itself with more bargaining power and finally an opportunity to increase prices to more sustainable levels.

This course correction will induce short-term pain, but it has the potential to put the whole industry on a more resilient path – one which will enable it to fulfill its potential.

Delivering on the promise of offshore wind

Despite the difficulties that the sector faces, the outlook for offshore wind is overwhelmingly positive. The global pipeline, outside of China, has risen to 180 GW, GWEC estimates, and governments are giving the sector the attention it deserves. Belgium, Denmark, Germany, and the Netherlands have announced a target of building 65 GW of offshore wind capacity in the North Sea by 2030 to turn it into a green energy hub. Additionally, the UK aims to deploy 50 GW by the end of the decade.

These targets are not just being set by European governments. The United States (30 GW), South Korea (14.3 GW), and Japan (10 GW) are all targeting ambitious buildouts of offshore wind this decade.

The ambition is there, now it needs to be delivered. To do that, the sector needs a sustainable and resilient supply chain. In other words, a profitable supply chain that can finance its own capacity expansions to keep up with booming demand. But the sector will also require government help.

An equally significant contributor to the rise in LCOE of offshore wind has been the current macroeconomic environment. Higher interest rates have pushed up the cost of capital, which by our own estimates have contributed approximately 50% to the increase in LCOE. If rates are cut in the coming years, this is sure to come down, but for the time being capital will remain expensive for the whole sector.

For now, dealing with this means accepting that offshore wind will become (a bit) more expensive. That doesn’t mean the cost reductions of the past decade will be erased – remember, offshore wind is nearly 60% cheaper today than it was in 2010 – and even with a LCOE of 70 EUR/MWh rather than 45 EUR/MWh, fixed offshore wind remains competitive compared to other (renewable and non-renewable) production capacity.

But conducive policies will be needed to help the sector flourish. Auctions going forward need to help create demand for fairly priced equipment and to help projects overcome higher costs of capital by, among other things, setting realistic strike prices and indexing tariffs. Over the medium and long term, this will help push down prices.

Just yesterday, the UK announced the new administrative strike prices (ASPs) for the next CfD allocation round. Offshore wind ASPs have gone up by 66% from the previous round to 73 GBP/MWh. This was warmly received by the industry, and it is an important signal that governments understand that prices have been too low historically to support a sustainable supply chain.

Governments will also need to help foster a regional supply chain. To do this, they will need to support the manufacturing base of the sector. Chinese giants will certainly increase their market share, but the pie is big enough for all suppliers to thrive and Europe is perfectly poised to keep a (more profitable) lion’s share. In this context, the recently released European Wind Power Action Plan is a step in the right direction. A key provision in the package is that the European Investment Bank (EIB) can now provide up to EUR 1.8 billion in loans to scale up manufacturing of monopiles and turbines, among others.

Though a big step, this will not be sufficient. Whilst the EIB has played an important role in financing offshore wind projects, they are not equipped to support sub-investment grade offshore wind suppliers on a corporate level. This is where national governments will need to step in.

If done right, these changes will create a more sustainable and competitive offshore wind supply chain that will enable the sector to meet the ambitious targets of governments around the world. We must look beyond the short-term pain that the sector is undergoing and appreciate that the fundamental rebalancing that the market is currently experiencing is long overdue and welcome.