Article

How renewables are driving Southern Africa’s energy success

2 December 2025

Southern Africa is emerging as one of the most dynamic regions for renewable energy on the continent, with South Africa at the forefront as the largest and most active market. The regional landscape is characterised by strong industrial demand for reliable and cost-effective energy. Renewable energy can provide both of those, along with contributing towards ambitious decarbonisation targets set in most sectors. A growing pipeline of private offtake projects, projects with some degree of merchant exposure, and ongoing public tenders for solar, wind, and standalone battery storage indicate strong fundamentals for continued growth in the short, medium, and long term. As we see in many markets worldwide, despite this momentum, persistent challenges such as grid congestion, regulatory bottlenecks, and environmental constraints continue to shape the pace and direction of development. Nevertheless, the cost-competitiveness and relatively short build-out times of renewable energy projects present a very attractive value proposition for offtakers and project developers/IPPs alike.

Expanding renewable opportunities across the region

South Africa remains the epicentre of activity. Public tenders for standalone battery projects signal a clear commitment to energy storage as a means of enhancing system stability. However, grid congestion in high-wind regions is limiting the connection of new wind projects, thus delaying development timelines.

Beyond public procurement, private offtake markets are gaining significant traction, especially among industrial and mining companies seeking to decarbonise operations while securing more reliable and cost-effective electricity. This trend is most advanced in South Africa but is rapidly expanding in Zambia, Botswana, and Namibia. The regional project pipeline is strong, with several initiatives already reaching financial close and entering construction, particularly in Zambia and South Africa.

High-impact technologies and evolving solutions

The technologies shaping Southern Africa’s renewable future are solar PV, onshore wind, and battery energy storage systems (BESS). Batteries are increasingly positioned as a cornerstone of the future market, both through competitive tenders and as critical instruments for grid management, including as a means to help unlock deeper penetration of renewable energy.

Another innovative trend is the emergence of energy trading. This can take the form of electricity trading entities—by aggregating demand from smaller or less creditworthy offtakers, intermediaries are helping to make projects more bankable, broaden participation in the energy transition, and reduce concentration risk. Alternatively, the South African Power Pool (SAPP) provides intra-day and day-ahead trading opportunities for projects—this is a valuable fallback in case the primary offtaker encounters any issues and is also increasingly looked at as the primary route to market for at least part of a project’s generated electricity.

Navigating operational, regulatory, and environmental challenges

Despite strong fundamentals and growth potential, local challenges remain significant. Grid constraints, particularly in South Africa, are a major obstacle. Transmission lines in resource-rich wind regions are already at or near capacity, slowing new connections and affecting the viability of future projects. In other countries in the region, there can be concerns around the reliability and availability of the grid and, therefore, the ability for projects to deliver generated electricity to end-users.

On the regulatory front, South Africa has made notable progress but continues to face difficulties as the slow unbundling of Eskom creates conflicts of interest and operational bottlenecks. Zambia is proactively moving, developing its open-access framework in collaboration with the private sector. This allows projects to progress even before regulatory reforms are fully finalised.

Environmental conditions also play a role. Zambia’s reliance on hydro has highlighted vulnerabilities during periods of drought, reinforcing the need for diversification into solar and wind as part of a more resilient generation mix.

The critical bottleneck: grid availability

The single biggest challenge to new project launches in Southern Africa is grid availability, reliability, and capacity, with South Africa’s wind sector being the most affected currently. The solution to this is simple in theory: massive build-out of grid infrastructure to improve resilience/reliability domestically; improve interconnection within the SAPP region and beyond; and extend the reach of electricity grids to improve electricity access (not least for more remote regions with large energy-consuming industries, such as mines). Of course, in practice, this is much more complex and nuanced. Aside from the technical/regulatory challenges, it would represent a huge financial investment and, since this is ultimately a public good, would require active and substantial participation from the public sector. Whilst it does not have to be funded upfront by governments or parastatal utilities, private sector financiers will require guarantees or similar assurances, which can be challenging in the context of many national utilities in the region going through challenging times financially. The private sector will have a role to play in this endeavour, and we already see several interconnectors between countries (including those looking to connect the SAPP to the East African Power Pool) being developed in the region. South Africa, for example, is gearing up to run a tender process for private sector investment into transmission line and transformer infrastructure, with the initial focus being to strengthen grid capacity between wind-resource-rich regions and the rest of the country. To facilitate this private sector investment, the South African government has been working with the IFC to set up an innovative guarantee structure.

Market dynamics and unique regional trends

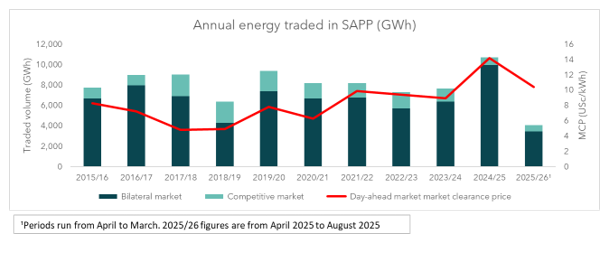

The SAPP is enhancing regional flexibility by enabling cross-border electricity trading. This allows projects in one country to serve offtakers in another, broadening market access and reducing single-country risk exposure. Beyond widening the pool of possible bilateral offtakers for projects, it also provides intra-day and day-ahead trading markets. Volumes traded bilaterally have grown over the last three years, whilst competitive markets have shown resilient liquidity in recent years.

Market capture prices (MCP) have been fairly stable in the last ~4 years—the spike in 2024/2025 could be linked to residual effects of severe droughts in some of the participating countries (which caused electricity shortages), driving up prices.

The rise of private offtake and merchant projects is also a defining characteristic of the region, with energy traders playing a pivotal role in enabling smaller consumers to access renewable supply. In parallel, financial innovation is gaining ground, with insurance products and contract-for-difference (CFD) mechanisms increasingly available to mitigate merchant risk and improve project bankability.

Outlook: decarbonisation and the role of key technologies

Looking ahead, the outlook for Southern Africa’s renewable sector is strong. ESI Africa projects that across the African continent, electricity demand is set to grow by 5% between 2025 and 2027. Solar PV, wind, and battery storage will remain the essential technologies in meeting this growing demand and driving decarbonisation (and replacement of ageing assets) due to their scalability, cost-effectiveness, and rapid deployment potential.

While green hydrogen and bioenergy are attracting early attention, these markets remain nascent. Hydrogen, in particular, faces high costs and uncertain demand, with local offtake more likely to develop in the near term than large-scale export.

The establishment of formal electricity markets in South Africa and other countries will be another game-changer. Having competitive electricity markets should help advance electrification in the region in a cost-effective way and will unlock opportunities for merchant projects and innovative risk management strategies. Projects will be able to rely on this market as an alternative route to market (e.g., as a fallback in the private offtake sector) and, from an offtaker perspective, it can help unlock more flexible structures that have less of a take-or-pay character (or at least reduce potential deemed energy payments). Of course, the risk allocation of these kinds of offtake structures needs to be right for such projects to be considered bankable. That is not to say that the market will move entirely in that direction, but we would expect to see a more diverse set of projects in terms of offtake structure, as we see in many European and Asian markets today.

Looking ahead

Southern Africa’s renewable energy sector is dynamic, expanding, and increasingly shaped by private offtake demand, evolving policy frameworks, and cross-border market mechanisms. While grid availability and regulatory complexity remain the region’s main challenges, the outlook is positive. The emergence of energy trading markets and entities provides a promising and exciting new way for projects to sell generated electricity and, with the addition of BESS, the opportunity to maximise capture prices. The potential to capture higher prices and thereby optimise returns is obviously appealing to equity investors; however, the downside risk will still need to be addressed (especially as most projects in the region will require a substantial amount of debt financing to fund the construction). Experience from other markets across the world where these structures have existed for a long time can be useful but cannot always be replicated directly, and new solutions will be needed to address region-specific risks. The good news is that many such products are already available and many more are being developed that will allow for the continued growth of the energy sector in an ever-changing environment.