Blog post

Is the UK Offshore Wind Industry Spinning Back into Gear through the CfD results?

4 September 2024

Yesterday the UK government announced the results of Allocation Round 6 (AR6) of contract for difference (CfD). The UK’s CfD scheme has long been touted as the mechanism of choice for incentivising investment in renewable energy projects – with the capital intensity of offshore wind (OW), this support mechanism is especially critical.

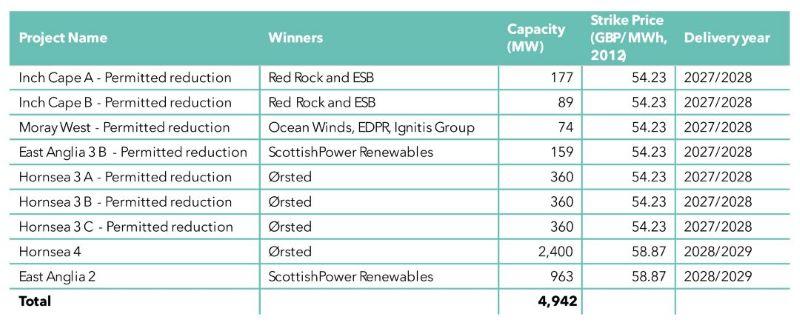

5.3 GW of OW has won a CfD and will start generating carbon-free electricity before 2029. The full list of winning OW projects is as follows:

Fixed-bottom offshore wind winners

Floating offshore wind winner

What is a CfD and why is it a good support mechanism?

The CfD structure is a financial hedge, whereby the government hedges the price of electricity for a renewable energy project over 15 years, at the strike price. It is a two-sided hedge: the government provides a top up when wholesale energy prices are below the strike price, or receives a payment from the generator when wholesale energy prices are above the strike price. This eliminates the risk of energy price volatility, allowing these infrastructure assets to derisk revenue uncertainty and raise project finance with competitive pricing. This ensures the lowest cost of capital for the project, and therefore reduces the project’s levelised cost of energy (LCOE) to prices that are now largely comparable to or lower than fossil fuels.

The CfD structure works because it gives developers enough certainty on the revenue profile to go out and build projects. It works for governments because it’s a way to mobilise the private sector to deploy renewable energy in the most cost-competitive way. And, taxpayers are protected from providing excessive support to generators when wholesale electricity prices are very high. The CfD structure is one of the most powerful and efficient ways to support renewable energy, demonstrated by the UK’s particularly successful build-out of OW over the last 10 years, with 15 GW already installed and 13 GW in construction or contracted.

Annus horribilis of 2023 with no OW bids in AR5

With significant rises in inflation, cost of capital, and supply chain costs, last year’s CfD Allocation Round 5 (AR5) collected no OW bids. The Administrative Strike Prices (ASPs) which is a ceiling price set by government based on the expectation of cost reduction, for fixed-bottom OW of 53 GBP/MWh (in 2012 prices) or ~78 GBP/MWh in today’s price, was far too low to attract any projects.

Swift reactions by government to uplift the CfD mechanism

Last November after the disappointment of AR5, the Tory government reacted by increasing the ASPs for AR6 (Allocation Round 6). The fixed-bottom OW ceiling price was set to 73 GBP/MWh (2012) or 108 GBP/MWh in today’s price. It was a positive signal for OW, but the CfD budget announced in March just wasn’t enough to support the scale of projects needed to reach the UK target of 50 GW installed by 2030.

When the Labour government was elected in June, they wasted no time announcing several new initiatives to address OW financing, leasing, grid connection, consenting, and supply chain. They also signalled a desire to increase the target to 55 GW. And, just the week before AR6 bid takes place, they announced a CfD budget increase from GBP 800 M to GBP 1.1 Bn for the fixed bottom OW pot, and GBP 105 M to GBP 270 Bn for the floating OW pot.

The successful results of AR6 today are underpinned by a successful CfD mechanism but also the right parameters: ceiling prices that account for all the current market conditions, and a budget that supports enough projects and drives the right level of competition. It requires constant dialogue between industry and government, and we applaud both for their collaboration.

Clear price readjustment of fixed-bottom OW projects

Around 70% of the capacity won today comes from projects bidding into a CfD for the first time. The other winners include projects that won a CfD in 2022 in AR4 at a price of 37.35 GBP/MWh (2012) – very low rates before the huge CAPEX increase that the industry has seen. Hence they re-bid a part of their capacity through this round to improve the project economics. Aside from RWE’s Norfolk Boreas project, all other AR4 fixed-bottom projects clear some capacity through this round.

Overall, while 5 GW of fixed-bottom OW awards is slightly short to comfortably meet the 2030 targets, the strike prices of 54.23 and 58.87 GBP/MWh (2012) or 80 and 87 GBP/MWh in today’s price are healthy enough to ensure that these projects will attract investment and be deliverable. It is a positive signal that the market has adjusted to a price-level that is more sustainable for the whole industry value chain.

The UK is set to deliver the first commercial floating wind project

We also need to celebrate AR6 for supporting the first commercial floating wind project in the UK. Green Volt is a 560 MW project developed by Flotation Energy/Vårgrønnn which won its CfD at a price of 140 GBP/MWh 2012, or 207 GBP/MWh in today’s prices for 400 MW of its capacity. The recently concluded AO5 tender in France awarded the country’s first 250 MW commercial scale floating wind project to Elicio and BayWa at a price of 86 EUR/MWh, or 73 GBP/MWh. While this discrepancy in price seems large, there are a range of tender design factors (whether the price of grid is included, duration of the CfD, the delivery year, and others) that make these auction prices complex to compare apples to apples (we hope to issue another blog on this very topic later this year). However, with the delivery year of 2028/2029, Green Volt is set to be the first commercial floating wind project delivered in the world. Thereafter, we will see projects from South Korea, Italy, and France coming online around or after 2030. With these first few projects providing invaluable lessons for the industry, we should start to see further reductions in the LCOE of floating wind in future UK CfD rounds.

Overall, there is still a long way to go, but strong momentum is beginning to build

This positive outcome in AR6 for both fixed bottom and floating wind, alongside interest rate cuts recently announced by the Bank of England and the European Central Bank, with the FED likely to follow this year, we expect that market sentiment for the industry will improve in the next 12 months. Have we caught the breeze, and could that very ambitious government target of 50-55 GW of OW by 2030 still be in reach?