Blog post

Is FER 2 the beginning of the offshore wind era in Italy?

17 September 2024

Italy, one of the most promising markets for floating offshore wind

We were recently asked by a client to indicate which countries we think could build commercial size floating offshore wind projects by 2030. They looked very surprised when we mentioned Italy in our very short list, together with the UK and Korea (and optimistically Taiwan).

In recent years, offshore wind has been a central topic of discussion in Italy, with the arrival of a long-awaited government decree and a large number of projects under development. The industry is now more vibrant than ever. Italy is currently considered the third most promising market for floating offshore wind development in the world.[1] What does this mean for a country that at the moment has only one operational fixed bottom offshore wind farm installed, for a total of 30 MW? What is actually required to unlock this potential?

Let’s start by digging into the numbers. Although the offshore wind target that the Italian government set in the latest NECP[2] was 2.1 GW by 2030, both market research and industry publications have adopted a much more bullish view. According to a number of industry studies[3], Italy has the potential to install 11 GW of offshore wind capacity by 2040 and to reach at least 20 GW of installed capacity by 2050. Achieving this growth has the potential to unlock a cumulative value of ~EUR 57 bn and to create approximately 27,000 new jobs between 2030 and 2050.

The scale of fixed bottom offshore wind and the potential for floating

In 2023, 10.8 GW of new offshore wind capacity was connected to the grid globally, contributing to a total of 75.2 GW installed by the end of last year. In Europe we saw the installation of 3.8 GW of capacity across the Netherlands, the UK, France, Denmark, Germany, Norway and Spain[4]. Though these figures are impressive, they are made up of fixed-bottom offshore wind installations, and therefore do not correspond neatly to the prospects of floating offshore wind. While fixed bottom technology is proven and well-suited for shallow waters like the ones in the North Sea, it is much less suitable for deep waters like the ones of the Mediterranean Sea.

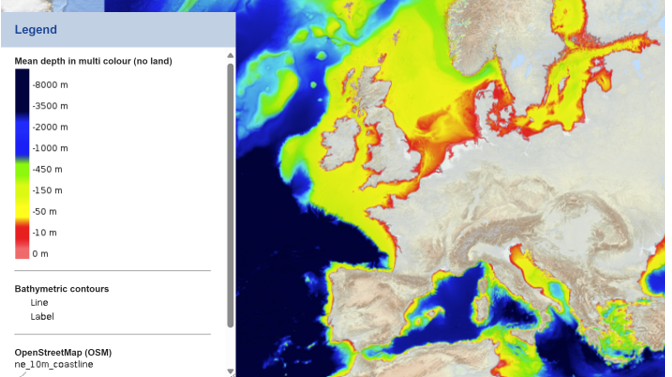

In order to provide a rough idea, the below European bathymetry map shows how deep the sea in the Mediterranean area is relatively to northern Europe. This implies that only few coastal areas are suitable for fixed bottom offshore wind and they are mostly located in the Adriatic Sea.

European bathymetry map. Source: European Commission (EMODnet)

The current size of the offshore wind market in Italy

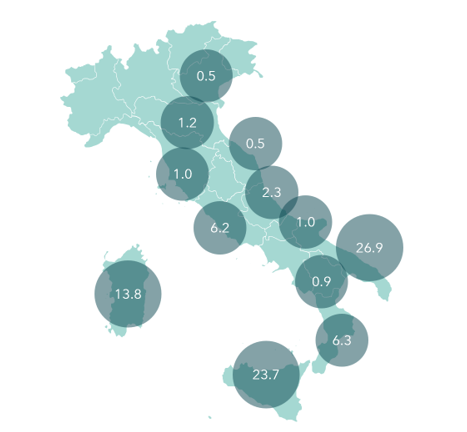

Terna, the transmission system operator in Italy, as of June 2024, received 84 GW of grid connection requests from a mix of fixed bottom and floating offshore wind projects. The map below shows the breakdown of the connection requests by region. The most competitive areas are the ones located in the southern part of the country, where wind yields are the highest. Apulia is leading the race with almost 27 GW, followed by Sicily which is close to 24 GW and Sardinia, that reached about 14 GW of requests.

Grid connection requests (GW) received by Terna. Source: Terna (30th June 2024)

Although we expect fixed bottom projects to play an important role to kick-start the Italian offshore wind industry in the next few years, it is clear from the maps shown above that large and utility scale long-term production can be best achieved through floating. The sizeable capacity requested to the grid operator will realistically not materialise in full and a mortality ratio assumption should be made. However, the scale of offshore wind development in Italy is signalling high hopes and expectations with regards to this industry, as evidenced by the presence of both local and international players.

FER 2: an important element to make offshore wind viable and bankable

Since the Covid-19 pandemic years, rumours about a decree named FER 2 have abounded. For non-Italian speakers, “FER” stands for “Fonti Energetiche Rinnovabili” and it is a term used to refer to renewable energy sources in general. FER 2 is a government decree that has the goal of promoting renewable energy production from innovative technologies and sectors that involve large installation costs. These include biogas and biomass, solar thermodynamic, geothermal, offshore wind, floating solar and marine energy. Given the high costs related to the development and construction of these plants and their innovative nature, a government subsidy scheme is essential to make these projects viable and bankable.

In August this year, offshore wind industry enthusiasts received exciting news: FER 2 decree entered into force, putting in place a CfD (Contract for Difference) scheme that will be awarded through public auction procedures run by GSE[5] throughout 2024 until 2028. In order to participate to the auction process, projects should hold a permit allowing for construction and operation of the plant, or at the very least a positive environmental impact assessment, an accepted grid connection quote and be in full compliance with specific environmental, performance and dimensional rules.

Across all the technologies covered by FER 2, ~4.6 GW of capacity will be incentivised, of which 3.8 GW will be allocated to both floating and fixed bottom offshore wind projects together. Fixed bottom projects will be allowed to participate only if located at least 12 nautical miles from the coast.

In short, the design of the offshore wind auctions will be as follows

- CfD scheme, which provides a hedge for the project against price volatility and has proven to be an arrangement that worked well in the recent cases of the UK and France

- Duration of 25 years, covering the full expected operational life of an offshore wind farm

- Strike price cap of 185 EUR/MWh applicable for both fixed bottom and floating offshore wind projects. As this price represents the ceiling price for the auction process, the actual tariff that projects will receive will then depend on the price of their bids

- A number of discounts to the strike price apply. A minimum 2% discount is requested when bidding into the first auction and the tariff will then be further reduced by 3% in each subsequent auction year. An additional discount applies in case of delays beyond the 60 months construction term

We can look to recent similar auction processes for context, as we consider the upcoming auctions in Italy. In the UK the results for Allocation Round 6 (AR6) have recently been released, allocating 5.3 GW of offshore wind capacity. The strike price awarded to winning fixed bottom projects, converted in today’s price in EUR is on average ~100 EUR/MWh, while the winning 400 MW floating project was awarded a tariff of 245 EUR/MWh in today’s EUR prices.[6] In France, the 250 MW floating offshore wind project that won the auction earlier this year was awarded a tariff of 86 EUR/MWh, while the auction ceiling was set to 140 EUR/MWh.

However, when comparing this type of information, additional factors should be taken into account. To mention a few examples, the inclusion or exclusion of the grid price within the strike price, the tenor of the subsidy scheme, country-specific factors, local supply chain, competitive market dynamics and expected wind yields. As such, all these elements make it very difficult to assess and perform a full comparison of auction design across countries.

All in all, we are convinced that the implementation of FER 2 has laid the cornerstone for an industry with sizeable potential. We expect projects subject to this CfD scheme to be well-regarded among investors and lenders and to be viable and bankable. The underlying reason for this is that a CfD scheme provides enough certainty on the future revenue profile of a project and substantially derisks it from merchant risk. This gives the required comfort to banks and investors to provide large initial capital commitments that are needed to build (especially floating) offshore wind projects.

FER 2 is the starting point for the build-out of a floating offshore wind industry in Italy

Obviously, a lot of challenges remain for the build-out of a full floating offshore wind industry in Italy including, among others, the availability of proper infrastructures and raw materials, the creation of a suitable supply chain and the development of political and macroeconomic conditions. However, with this incentive scheme in place and upcoming auctions, we consider the Italian offshore wind industry to be at the dawn of a new era.

[1] Based on an analysis from ANEV (National Wind Energy Association), confirmed by GWEC (Global Wind Energy Council)

[2] National Energy and Climate Plan, 2024

[3] ANEV and Community Floating Offshore Wind

[4] Source: GWEC, 2024

[5] Gestore Servizi Energetici, a state-owned company that promotes and supports the use of RE in Italy and is responsible for the management of existing support schemes for renewable energy sources

[6] Refer to this blog post for more details: UK offshore wind industry – Green Giraffe Advisory (green-giraffe.com)