Blog post

What is the capture price for nuclear?

Energy Blog, 29 April 2021

“Capture prices” have become a hot topic for renewables lately. Projects are increasingly exposed to short term spot prices even if they benefit from long term price regimes like CfDs (contracts for difference) – the power is still sold in the wholesale market in any case, and subject to the discipline of balancing costs and marginal pricing. The increasing penetration of wind and solar in many markets means that the industry is forced to grapple with a growing number of periods where there is a lot of wind power or solar power at the same time, as all projects in a given area are subject to the same weather patterns. When there is a lot of wind, and correspondingly a lot of wind power generated, supply may become too plentiful, causing prices to go down. When there is no wind, prices will go up, but wind projects will not get the benefit of these as they are not producing. If the production profile is not in line with demand, the capture price received by the project can be lower than the average wholesale price for all generation. While quite location-specific, it is generally estimated that the capture price for wind is lower than the average price (and is expected to go down a bit further in coming years), whilst the capture price for solar is often higher than the average price (thanks to power demand generally being higher during the day), with trends for the future varying quite wildly depending on demand patterns and expected future penetration.

In that context, it is worth asking about the capture price of nuclear. The nuclear industry prides itself on providing reliable, baseload capacity and thus supposedly providing more valuable power than renewables. But is it actually true?

First of all, it should be noted that as relatively inflexible baseload, nuclear is a price taker, not a price maker. Nuclear plants usually bid low, come early in the merit order, and sell power irrespective of the price being set by other producers. This price is usually determined by gas-fired plants pricing for a positive spark spread. French engineers at EDF will tell you how they have managed to make their fleet “load-following” to a decent extent, improving the disparity between their capture price and the average price , but that largely means cutting down production at times of excess supply rather than choosing when to produce more. So nuclear plants, by and large, get the market price whenever they produce (which is most of the time) and this does not equal the average price as they will be producing a higher share of total production at times of low demand (and low prices), and a smaller share of total production at times of high demand (and high prices).

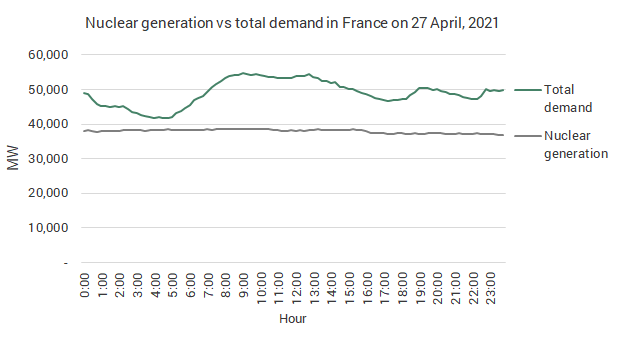

So inevitably nuclear capture prices, like for any baseload producer, are structurally lower than average power prices because they produce power irrespective of demand and find it very hard to scale down production. The case study is France – even after 30 years of efforts to manage its largely nuclear fleet more effectively, France still sells excess power cheaply at night (typically, to Switzerland) and buys more expensive coal-fired (or solar) German power during the day, because nuclear baseload is not sufficient to deal with the massive daily ups and downs of electricity demand.

Data source: Réseau de Transport d’Électricité

This inevitable disparity between the capture price and the average power price continues to cause headaches for the nuclear industry. The average capacity factor for the French nuclear fleet has been, due to the optimised management of production, around 75% in recent years (and probably lower in 2020 due to Covid) which, because of the very high fixed cost base, means that the cost of producing a nuclear MWh is 25-30% more expensive than if all plants were actually producing at full capacity. An under-producing nuclear fleet with high fixed costs and a lower capture price will struggle even more to make money. In the light of this it’s not really a surprise that that no nuclear plants are being built under merchant pricing (as opposed to more than a few solar and wind projects). And is it any wonder that the CfD level that makes nuclear economically viable, from the perspective of its own promoters, is 92.5 GBP/MWh (inflated, over 35 years), as set for Hinckley Point in the UK? That price is required to cover not just the extremely high upfront investment costs, but also the relatively unfavourable cost of capital due to the perceived higher construction risk and the mediocre capture price linked to the inflexible production profile of the plant.

So in summary, capture prices will nearly always be different from the average market price in any given electricity market, because demand and supply rarely follow the same trajectories. For wind and solar, the capture price tends to be lower than the average price but that is an acknowledged part of their business models. Nuclear, with its claims of reliability and full time availability, actually has a similar problem – and that further undermines its increasingly hard to sustain claims that it is cost competitive with renewable energy. Whatever the criterion, nuclear seems to be at a long-term disadvantage against modern wind or solar generation.

Jérôme Guillet co-founded Green Giraffe in 2010 and was a Managing Director until 2021.